A closely followed on-chain analyst believes that Bitcoin (BTC) is at a critical juncture and may be one big move away from signaling bull market exhaustion.

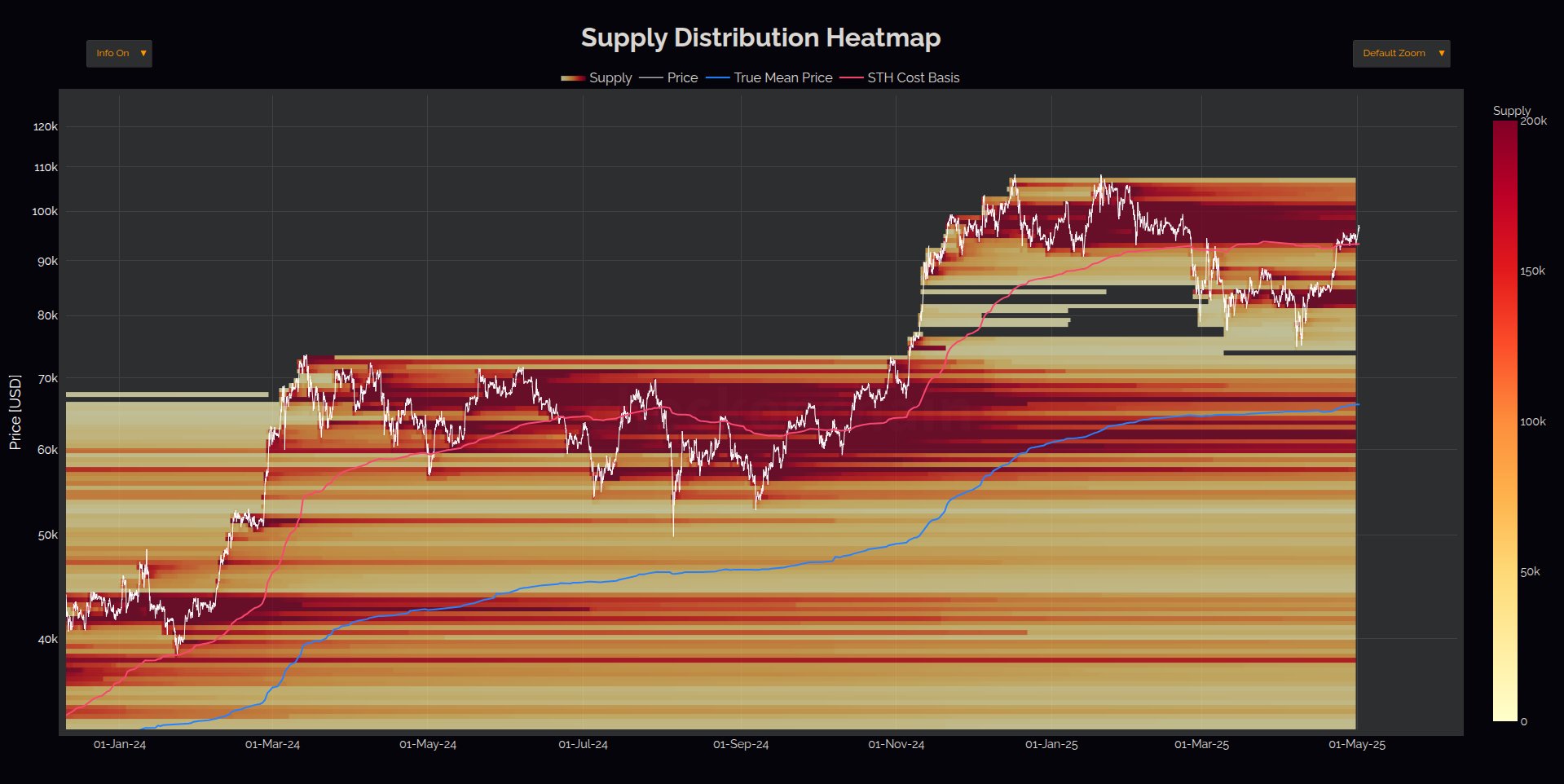

Pseudonymous analyst Checkmate tells his 114,800 followers on the social media platform X that Bitcoin is facing heavy selling pressure at current levels based on its heatmap, a visual tool that shows where buy and sell orders are stacked in the orderbook.

-->“Bitcoin is working its way through a very dense supply cluster between $93,000 and $100,000.

Pretty much blue skies above $100,000.”

Source: Checkmate/X

Source: Checkmate/XAccording to the analyst, Bitcoin bulls need to step up and gobble up the selling pressure all the way up to $100,000. Otherwise, BTC could print a bearish lower high structure and signal that the bull market is over.

“In my view, it’s pretty important that Bitcoin clears this price zone in the near term.

We’re sitting right in the middle of a decision point, and all it will take is one big red or green candle from here to convince people of a lower high, or bull continuation, respectively.”

Source: Checkmate/X

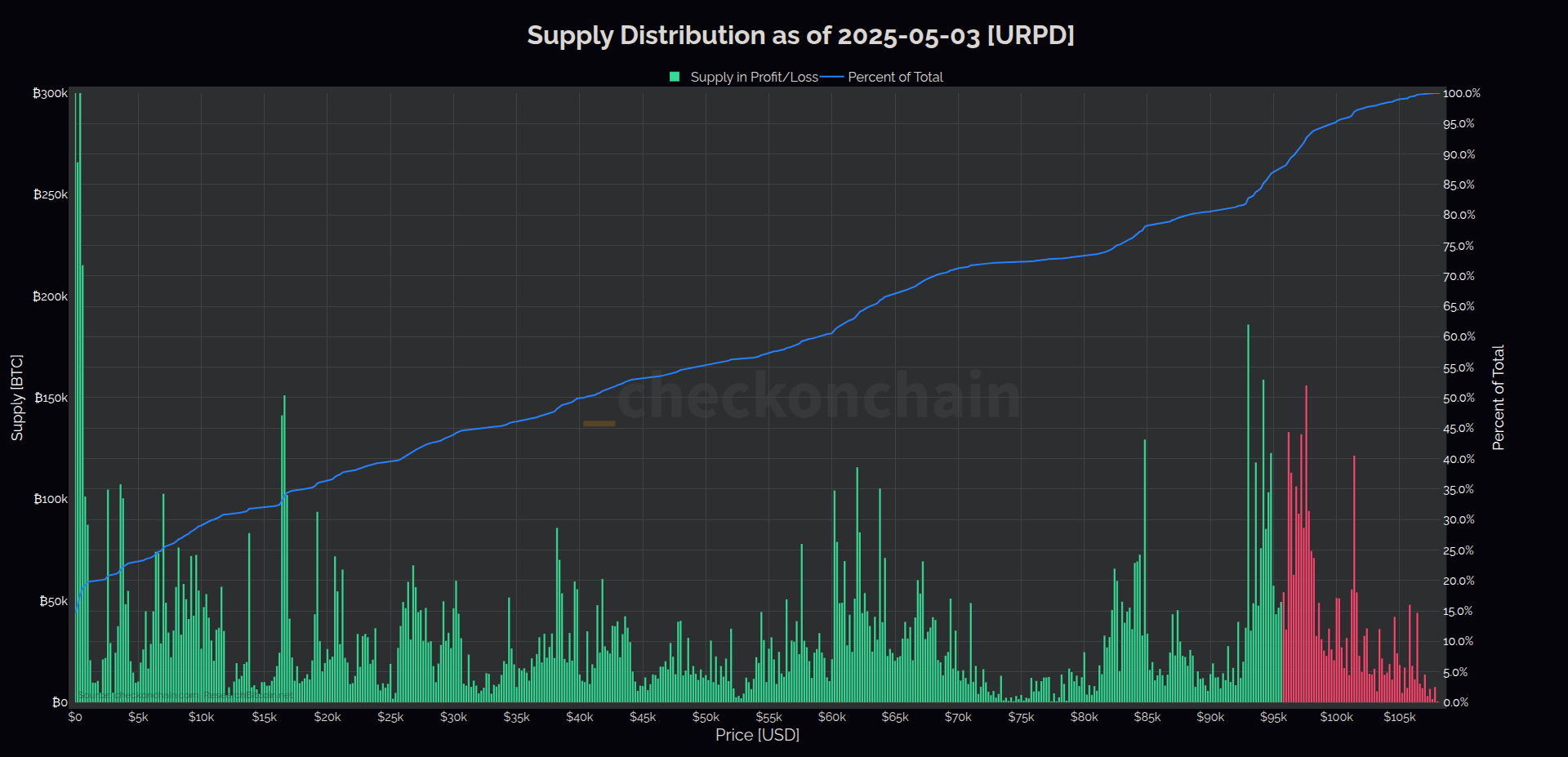

Source: Checkmate/XCheckmate’s chart shows that hundreds of thousands of BTC positions are underwater as Bitcoin struggles to move above $95,000.

The analyst also says that hesitation at current levels might be seen as a sign of trend exhaustion.

“We don’t want to keep chopping, to be honest, need to establish a clear trend.”

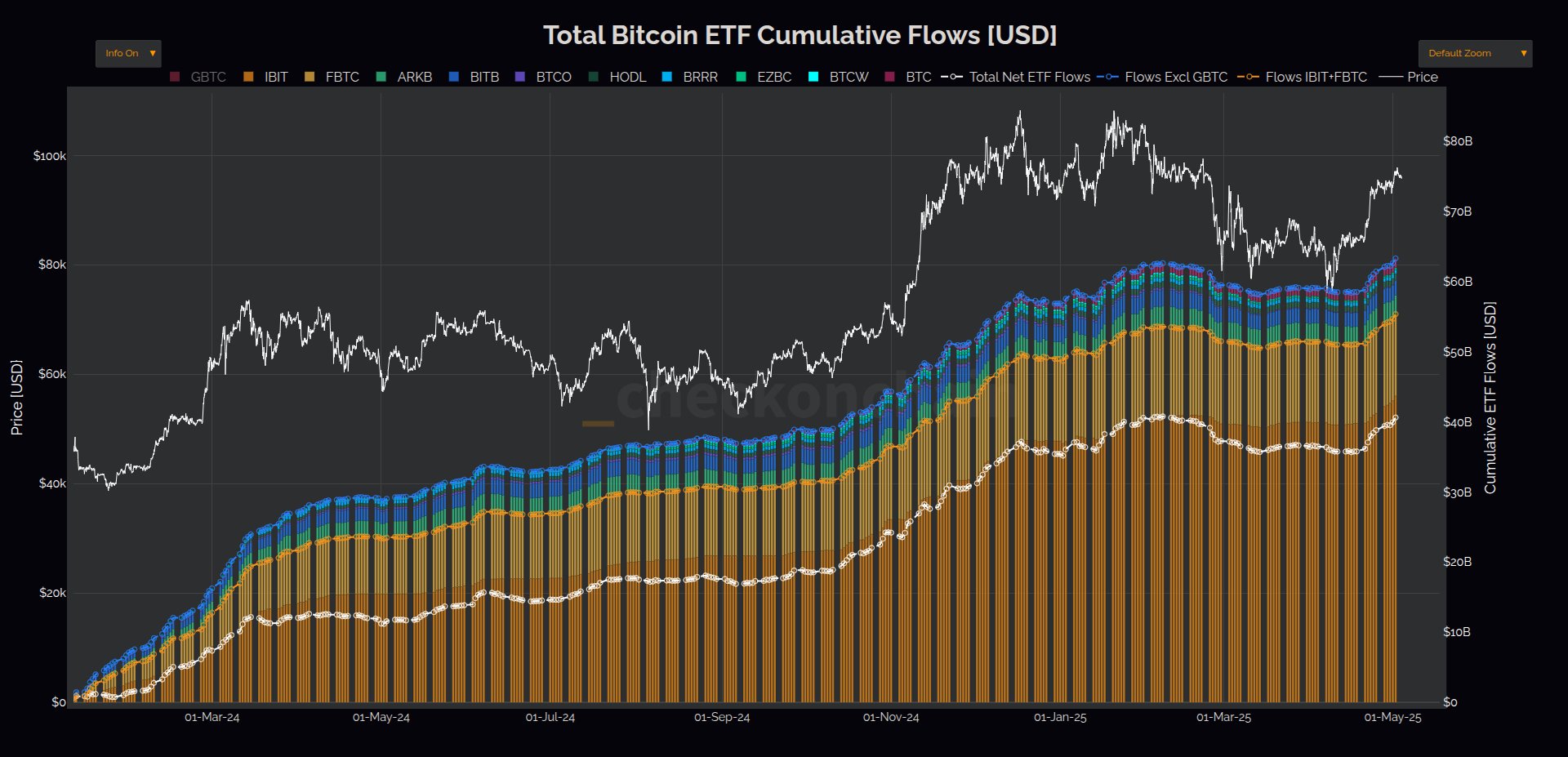

While it appears that sellers have the upper hand above $95,000, Checkmate notes that demand for Bitcoin exchange-traded funds (ETFs) remains strong.

“Cumulative inflows into the Bitcoin ETFs have hit a fresh ATH (all-time high) of $40.62 billion.”

Source: Checkmate/X

Source: Checkmate/XAt time of writing, Bitcoin is trading for $94,816.