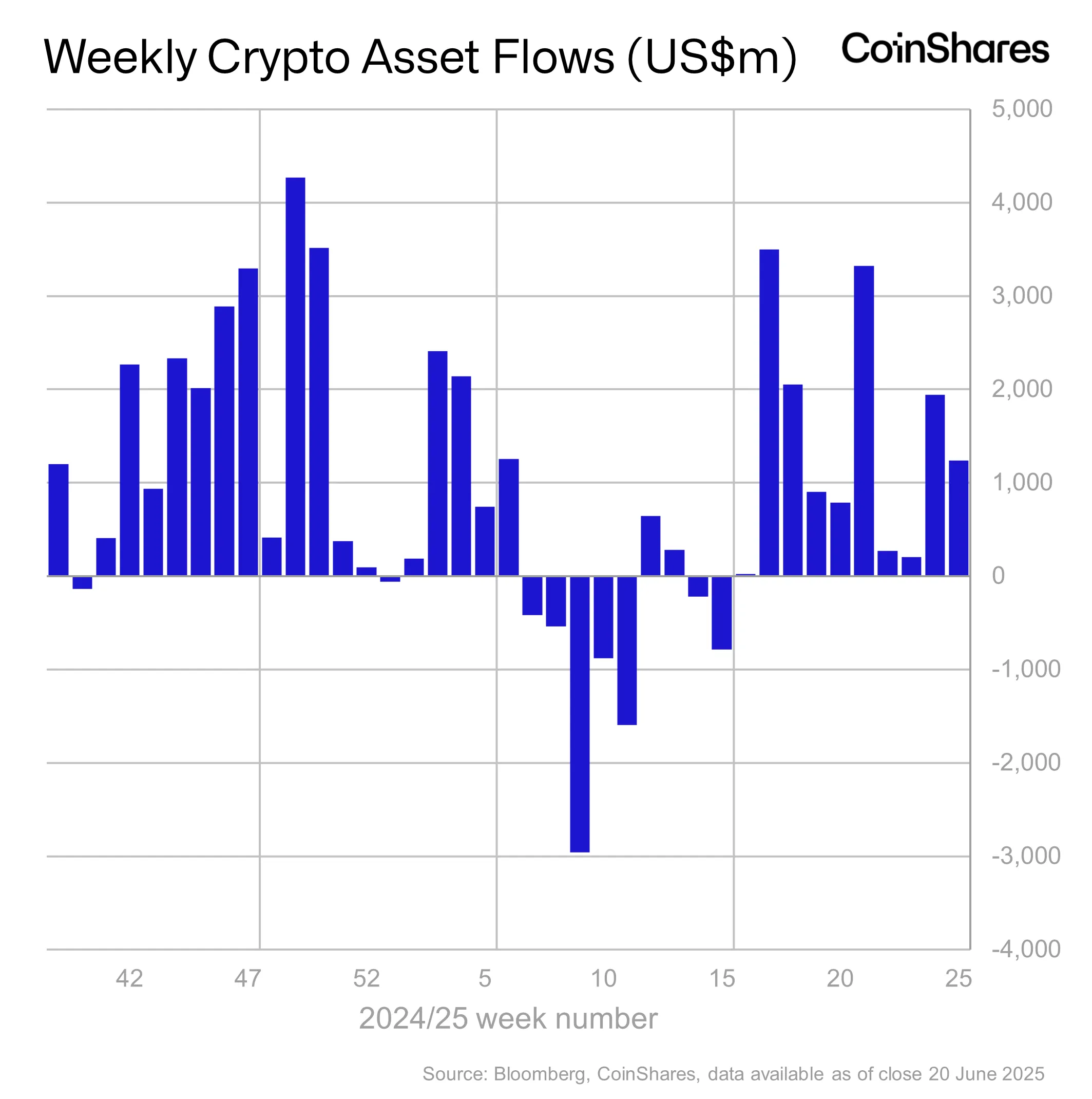

Digital asset management firm CoinShares says Bitcoin (BTC) and Ethereum (ETH) are leading crypto products into another week of inflows.

According to its latest Digital Asset Fund Flows Weekly Report, CoinShares says that institutional crypto investment vehicles enjoyed over $1 billion in inflows last week alone, despite geopolitical tensions.

-->“Digital asset investment products recorded their 10th consecutive week of inflows, totaling US$1.24bn last week and pushing year-to-date (YTD) inflows to a new high of US$15.1bn.

However, the surge in activity earlier in the week tapered off in the latter half, likely due to the US Juneteenth holiday and emerging reports of US involvement in the Iran conflict.”

Source: CoinShares

Source: CoinSharesRegionally, the US led internationally with $1.25 billion in inflows. Germany and Canada also provided $10.9 million and $20.9 million worth of inflows, respectively. Meanwhile, Hong Kong and Switzerland subtracted from the total with nearly $40 million in outflows combined.

Bitcoin led all inflows with $1.1 billion.

“… Despite the recent price correction, indicating that investors were buying on weakness. This sentiment was further supported by minor outflows from short-Bitcoin products, which totaled US$1.4m.”

ETH products experienced their ninth consecutive week of inflows. The current streak is the longest for Ethereum since 2021, reaching a cumulative total of $2.2 billion worth of inflows.

Follow us on X, Facebook and Telegram