CryptoQuant’s CEO says that Bitcoin is effectively a deflationary asset now that BTC is getting rapidly accumulated by Michael Saylor’s Strategy (MSTR).

In a post on the social media platform X, Ki Young Ju tells his 422,200 followers that despite Bitcoin’s inflation, Strategy is now gobbling up coins at a quicker rate than what miners can produce.

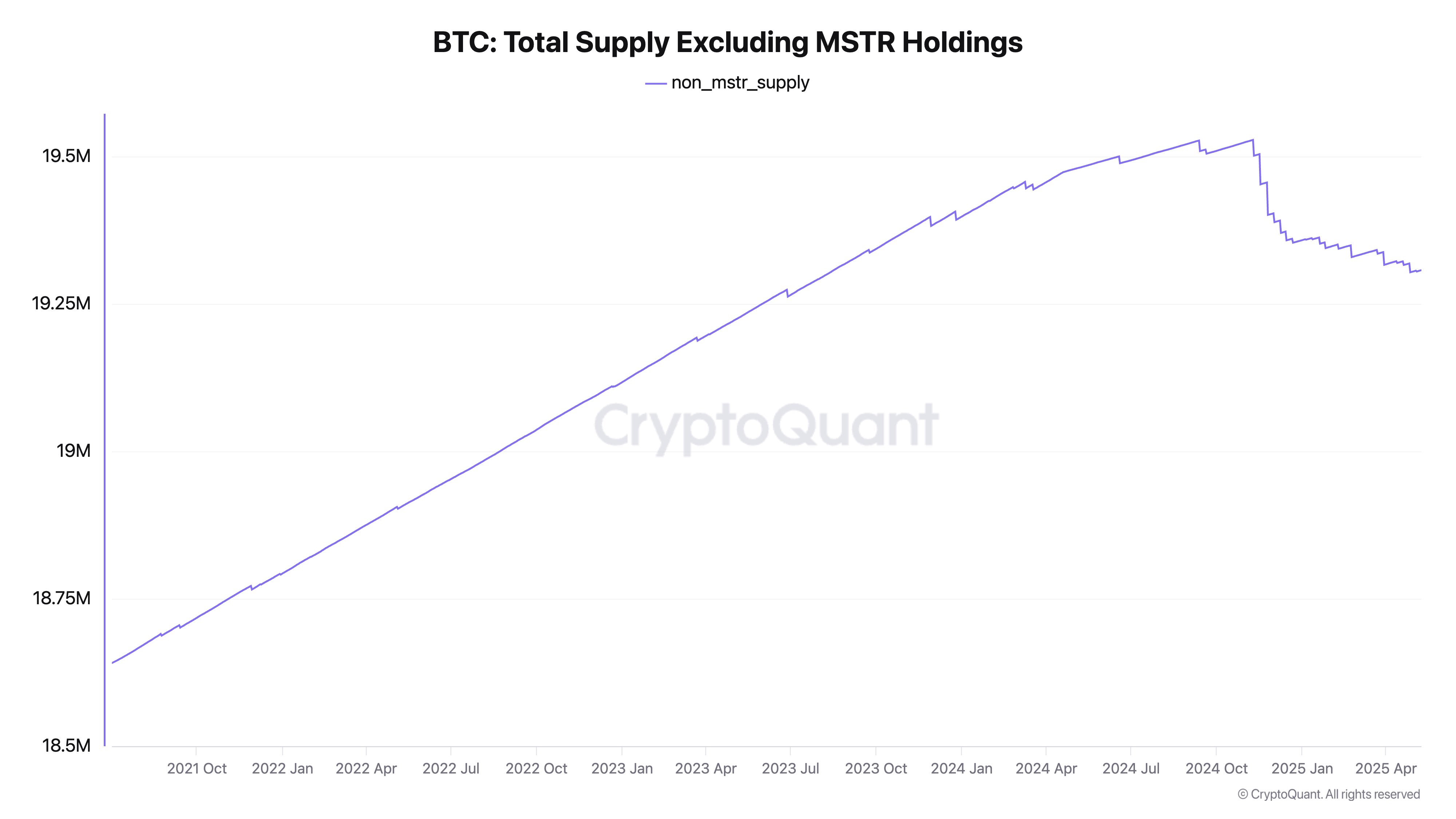

-->CryptoQuant’s data appears to show that when excluding coins held by MSTR, the supply of BTC has been going down since late last year.

“Bitcoin is deflationary.

Strategy is buying BTC faster than it’s mined. Their 555,000 BTC is illiquid with no plans to sell. MSTR’s holdings alone mean a -2.23 annual deflation rate – likely higher with other stable institutional holders.”

Source: CryptoQuant/X

Source: CryptoQuant/XAccording to BitcoinTreasuries.net, Strategy has 555,450 BTC worth about $58 billion, representing 2.645 of Bitcoin’s 21 million supply.

Ju recently backtracked on his previous call that the Bitcoin bull market was over. The CEO said that Bitcoin’s market structure is more complex now, with many different large players, making forecasting harder.

According to the CryptoQuant CEO, selling pressure on BTC has eased in the face of “massive inflows” from spot exchange-traded funds (ETFs).

“In the past, the Bitcoin market was pretty simple. The main players were old whales, miners, and new retail investors, basically passing the bag to each other. When retail liquidity dried up and old whales started cashing out, it was relatively easy to predict the cycle peak. It was like a game of musical chairs – everyone tried to cash out at once, and those who didn’t ended up stuck with their holdings.

But now, the Bitcoin market has become much more diverse. ETFs, MicroStrategy (MSTR), institutional investors, and even government agencies are considering buying and selling Bitcoin. In the past, profit-taking cycles were triggered when whales cashed out at the peak, leading to a chain reaction of sell-offs and a price drop.”

At time of writing, Bitcoin is trading for $114,112.