Institutional digital asset investment vehicles have enjoyed over $16 billion in inflows over the last eleven weeks, according to crypto asset management firm CoinShares.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that inflows into institutional crypto investment vehicles in the first six months of 2025 (H1) fall just short of the inflows seen last year.

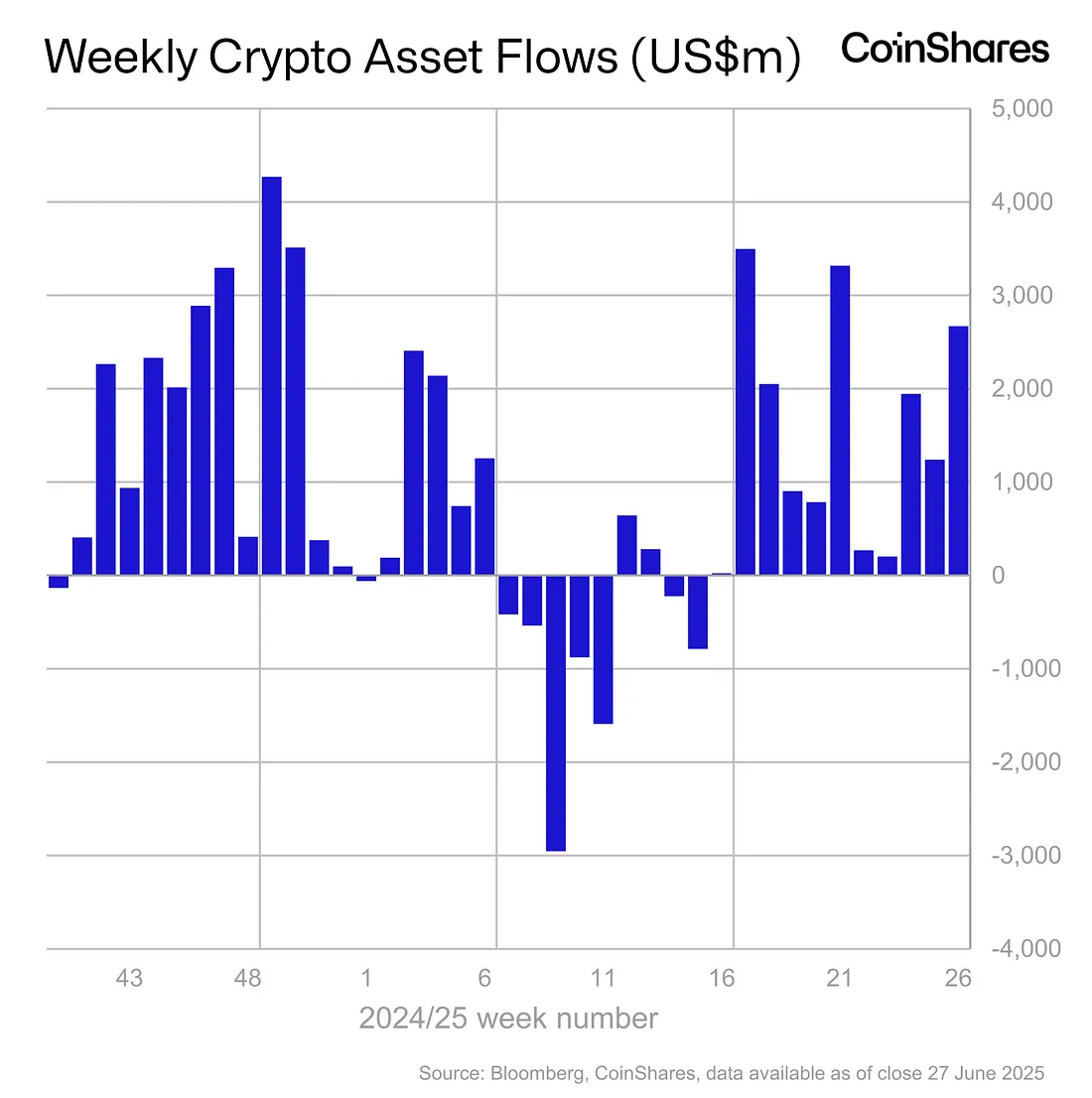

-->“Digital asset investment products saw inflows of US$2.7bn last week, marking the 11th consecutive week of inflows totalling US$16.9bn. Reflecting on the half-year mark, inflows are on a similar track to 2024, where inflows to end-June were at US$18.3bn.

We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy.”

Source: CoinShares

Source: CoinSharesRegionally speaking, the US led the charge with $2.65 billion in inflows. Switzerland and Germany also provided inflows of $23 million and $19.8 million. Meanwhile, Canada, Hong Kong, and Brazil saw outflows of $13.6 million, $2.3 million and $2.4 million, respectively. Hong Kong, in particular, witnessed $132 million in outflows in June alone.

Bitcoin (BTC), per usual, took the lion’s share of inflows.

“Bitcoin accounted for 83 of total inflows last week, attracting US$2.2bn. In contrast, short-Bitcoin investment products saw a further US$2.9m in outflows, bringing year-to-date (YTD) outflows to US$12m — a clear indication of broadly positive sentiment towards Bitcoin this year.”

Ethereum (ETH) continued its inflow streak with $429 million in inflows last week alone.

Follow us on X, Facebook and Telegram