The chief executive of crypto intelligence firm CryptoQuant is identifying one catalyst that could send Bitcoin (BTC) to a $1 million price tag.

In a new thread on the social media platform X, Ki Young Ju says that by the time the top crypto asset by market cap reaches $1 million, it will have overtaken gold.

-->According to Ju, the crypto king reaching nine figures is inevitable as investor demand shifts from gold to BTC.

“In 2004, before gold ETFs were approved, gold’s market cap was $1 trillion. Today, it’s $17.8 trillion. If we assume gold’s intrinsic value as a precious metal is $1 trillion, then around $16.8 trillion represents its demand as a safe-haven asset and a hedge against inflation.

Bitcoin’s current market cap is $2 trillion, and it could go up 750 if gold demand shifts to BTC. Considering inflation, Bitcoin reaching $1 million isn’t about if it will happen – it’s about when. People will start discussing the gold flippening within five years.”

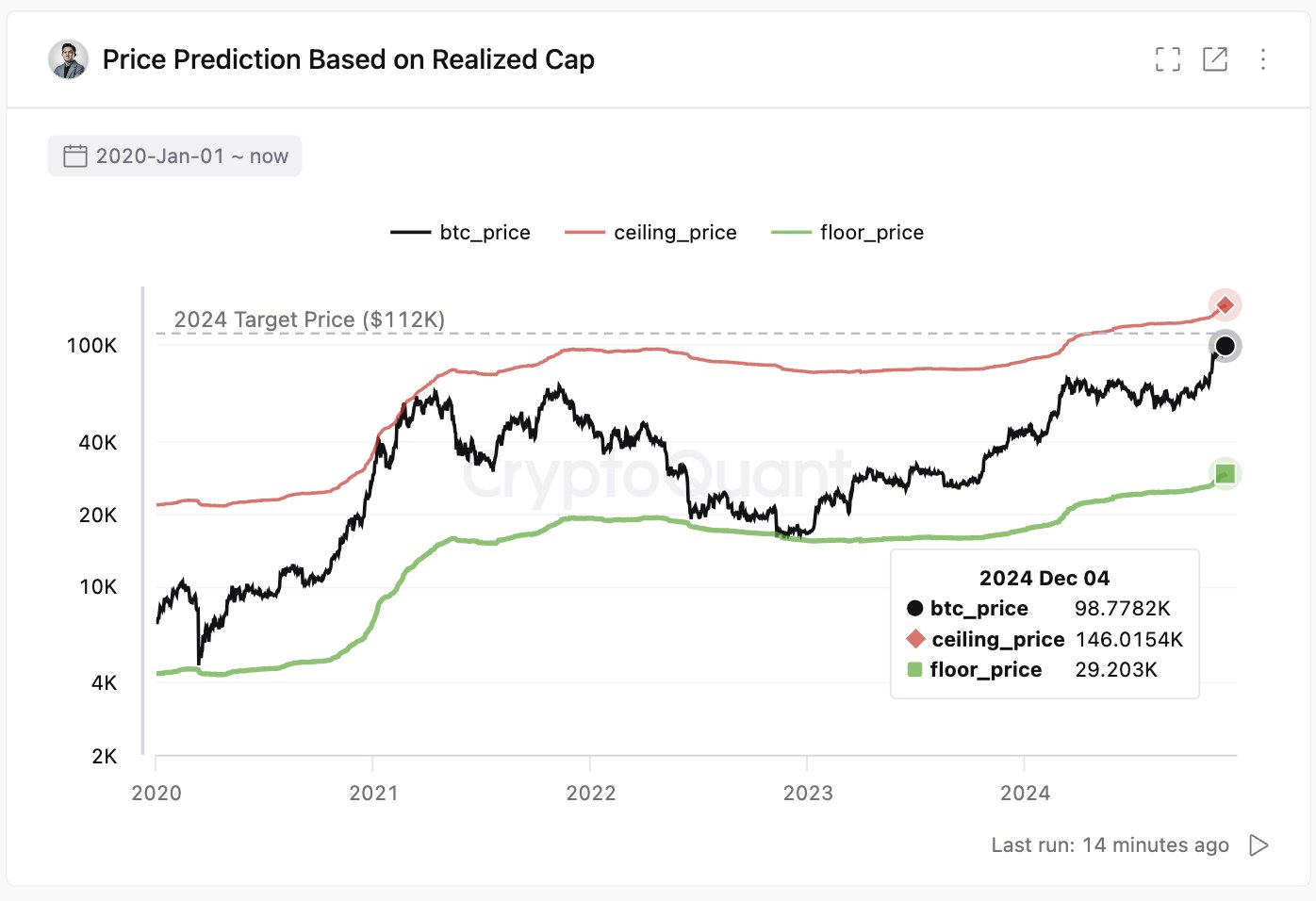

Ju goes on to note that BTC has yet to form a bubble, despite reaching the $100,000 milestone for the first time ever earlier this week.

“Fresh capital is fueling Bitcoin. As the realized cap grew, the ceiling price increased from $129,000 to $146,000 in 30 days. At $102,000 it’s far from a bubble – it would need a 43 surge to hit the threshold often considered a bubble.”

Source: Justin Bennett/X

Source: Justin Bennett/XBitcoin is trading for $99,069 at time of writing, a 1.8 decrease during the last 24 hours.