The biggest stock exchange in Russia is adding futures trading for asset management titan BlackRock’s iShares Bitcoin Trust ETF (IBIT), one of the biggest exchange-traded funds in the world, to its suite of products.

In a new announcement, Moscow Exchange (MOEX) – the government of Russia’s venture into the world of crypto assets – says that starting on June 4th, it’s adding support for the product, though only to accredited investors.

-->“Please note that today, June 4, 2025, trading in the IBIT-9.25 (IBU5) futures contract, permitted only to qualified investors, begins… Qualification checks on the exchange side will be implemented from June 23, 2025.”

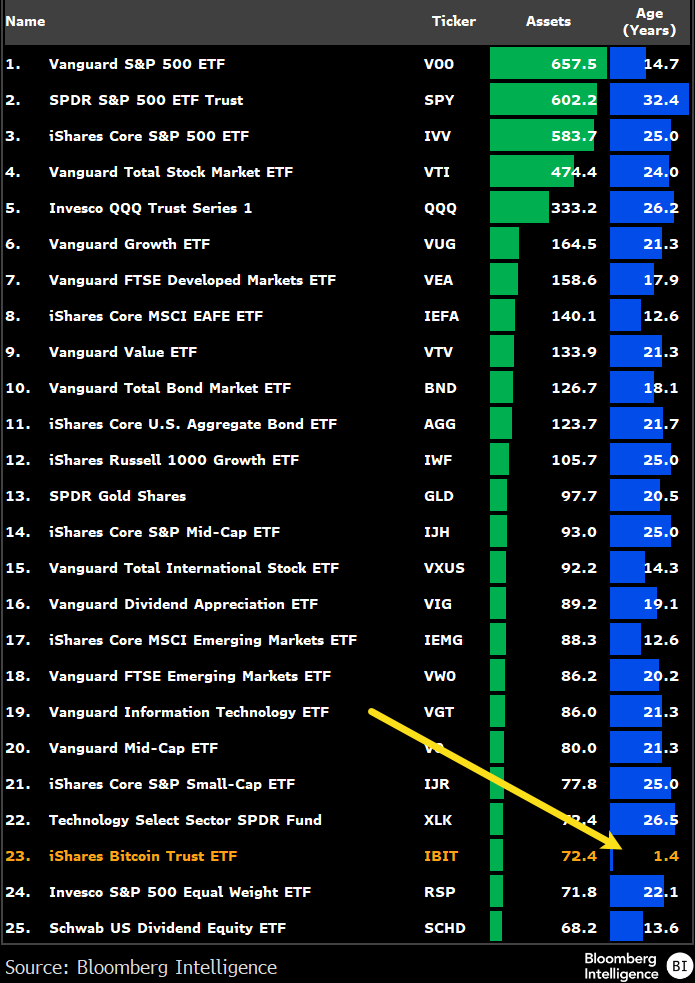

IBIT, which launched in January 2024 after years of having its approval halted by the U.S. Securities and Exchange Commission (SEC), recently entered the list of top 25 ETFs in the world, coming in at just over $72.4 billion in assets under its management.

According to Bloomberg ETF specialist Eric Balchunas, the launch is significant because IBIT is still relatively young compared to most ETFs on the list.

“Here’s a table of the Top 25 biggest ETFs and their age. At 1.4 yrs old IBIT is [the] youngest on the list by nine times. It’s like an infant hanging out with teenagers and twenty-somethings. Quite [possibly] the most insane IBIT stat yet.”

Source: Eric Balchunas/X

Source: Eric Balchunas/XIBIT is trading for $59.92 at time of writing, a marginal decrease during the last 24 hours.

Follow us on X, Facebook and Telegram