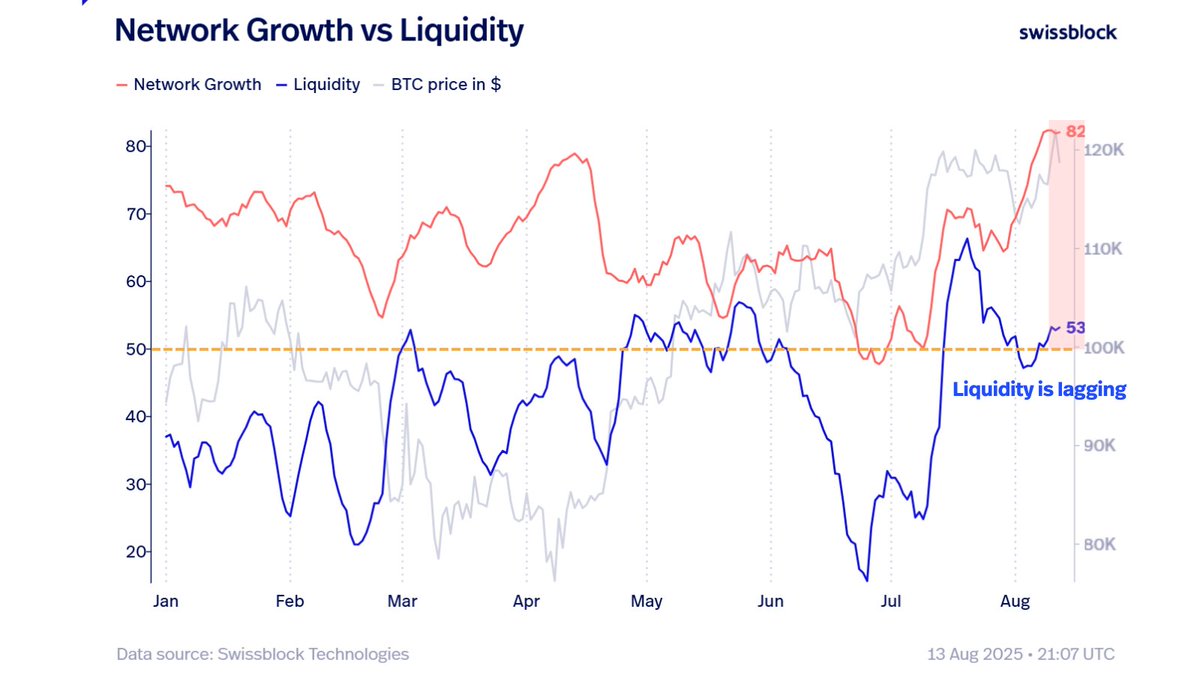

One key ingredient is missing for Bitcoin (BTC) to soar well past its all-time highs, according to crypto analytics platform Swissblock.

The analytics platform says that the on-chain liquidity metric needs to increase to trigger a convincing Bitcoin breakout.

-->On-chain liquidity refers to how easily and efficiently Bitcoin can be bought or sold without significantly impacting BTC’s price. A low liquidity environment suggests there are not enough buyers to absorb sell orders, triggering price declines.

“BTC’s structure is strong, but liquidity is the missing catalyst for a breakout beyond ATH (all-time high) with conviction. Meanwhile, capital rotation into ETH and alts is in full motion, setting the stage for late-cycle altcoin outperformance. The next big move will be decided by where new investor flows choose to land.”

Source: Swissblock/X

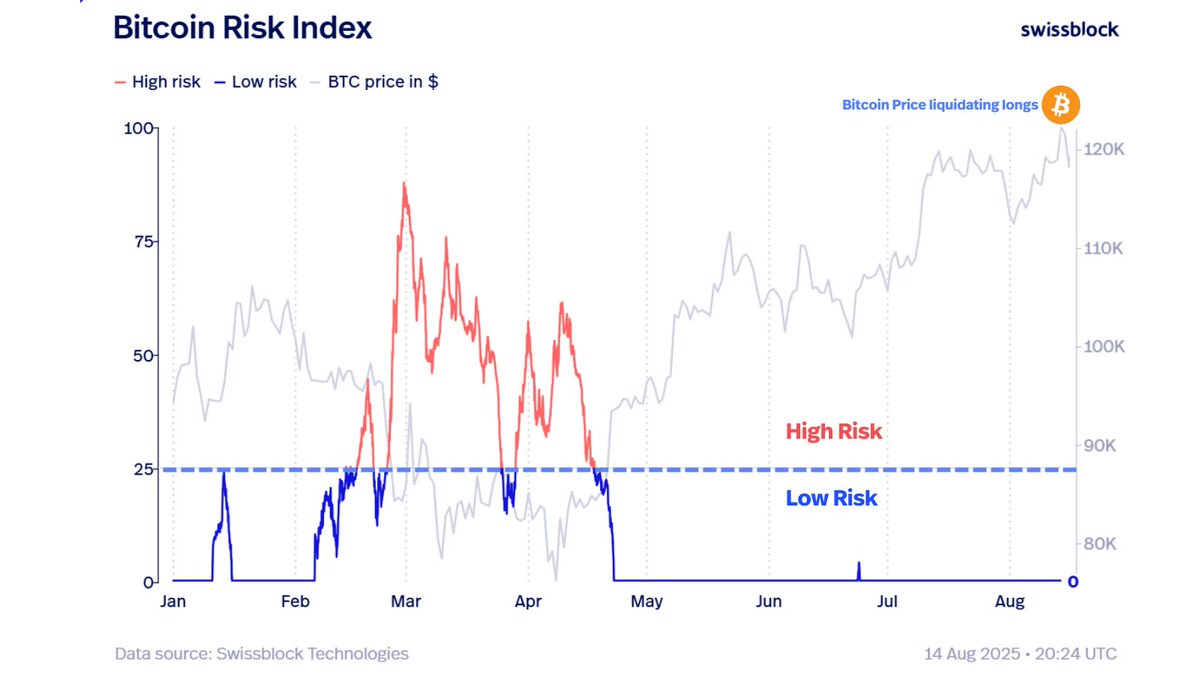

Source: Swissblock/XSwissblock also says that, based on the Bitcoin Risk Index, the flagship crypto asset remains in a bull market and short-term corrections are golden opportunities for investors.

The metric aims to evaluate Bitcoin’s current risk environment by aggregating various data points, including on-chain valuation and cost-basis metrics.

“As long as risk stays low, this is a buy-the-dip environment. Bitcoin punishes the over-leveraged in the short term, and downside volatility is rising – but structural risk remains contained. Low-risk regime: dips are opportunities.”

Source: Swissblock/X

Source: Swissblock/XBitcoin is trading for $117,422 at time of writing, down marginally on the day.