The "Anchorpoint" joint venture aims to capitalize on Hong Kong‘s newly launched stablecoin licensing regime.

The "Anchorpoint" joint venture aims to capitalize on Hong Kong‘s newly launched stablecoin licensing regime.

The world’s largest crypto exchange has turned to BBVA in a bid to rebuild trust and limit counterparty risk.

Dorsey‘s fintech company now holds 8,692 BTC worth over $1.15 billion, according to the company’s latest 10-Q filing.

Two Seas Capital is challenging Core Scientific’s $9 billion sale to CoreWeave, arguing the terms significantly undervalue the miner.

Hut 8 CEO Asher Genoot told investors today the Winklevoss brothers bought into American Bitcoin with BTC rather than cash.

The ETH treasury firm is selling shares of its common stock for $19.50 per share to raise funds that will go toward adding to its nearly $2 billion Ethereum stockpile.

The acquisition follows Ripple’s application for a banking license in July.

With new duties hitting dozens of countries, analysts warn of ripple effects on investor sentiment and crypto mining operations.

JPMorgan’s permissioned platform will help reduce settlement risk, time, and cost by enabling 24/7 programmable payments

WazirX creditors say the order affirms user rights and raises hope for stronger regulatory oversight after the exchange’s $235 million hack.

Ten offshore platforms were flagged by regulators earlier this week and are now inaccessible through at least one major ISP.

CZ argued that a Delaware court has no authority over him in a case tied to 2021 crypto transfers from Sam Bankman-Fried.

Galaxy recently sold 80,000 Bitcoin on behalf of a Satoshi-era investor. The company‘s Q2 earnings fell short of expectations.

Centralized crypto exchange Coinbase is set to raise $2 billion in convertible senior notes, as COIN sagged in pre-market trading.

The Open Network and Telegram inked an "exclusivity deal” last month.

Compass Point analysts view cooling interest in crypto trading among retail investors as a potential headwind for the exchange.

The Bitcoin miner started stacking ETH just 35 days ago.

Although Coinbase shares fell 17 on Friday, the stock could gain ground as the trading platform expands its services through different acquisitions, analysts wrote.

MicroStrategy aims to have the biggest corporate treasury stash ever—Bitcoin or otherwise—while Metaplanet raises $3.7 billion for its BTC buying spree.

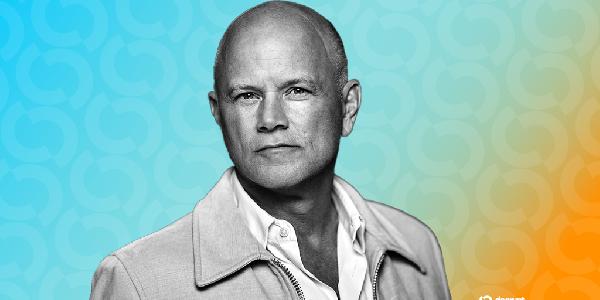

Bitcoin treasury giant Strategy already holds $72 billion worth of BTC, but Michael Saylor has even larger ambitions.

"We can‘t and won‘t stand for it," said Coinbase Chief Legal Officer Paul Grewal as the crypto exchange filed an opposition brief.

Bitcoin-backed yield products may appeal to retirees seeking alternative income, but only if structured with safeguards, sources told Decrypt.

Visa has grown its stablecoin settlement infrastructure to support three new tokens and two extra blockchains in its latest crypto push.

The US-based crypto exchange clocked $1.5 billion in revenue, coming in below analysts’ expectations.